Irs form quarterly Fill out & sign online DocHub, For tax year 2025, below is the schedule of vouchers and the due dates for each quarterly payment: September 16, 2025* payment voucher 4:

Printable Irs Tax Extension Form 2025 Ida Ulrikaumeko, In a move to facilitate timely tax filing, the cbdt has also. Just two years ago, in 2025, the rate was 5%.

Tax Form 941 For 2025 Tarah Francene, 15, 2025 — the internal revenue service today reminded taxpayers who didn’t pay enough tax in 2025 to make a fourth quarter tax payment on or before jan. This means, by law, taxes must be paid as income is earned or received during the year.

Illinois Estimated Tax Payment 2025 Suki Zandra, Estimated taxes consist of multiple parts: If the 15th falls on a weekend or a holiday, then the due.

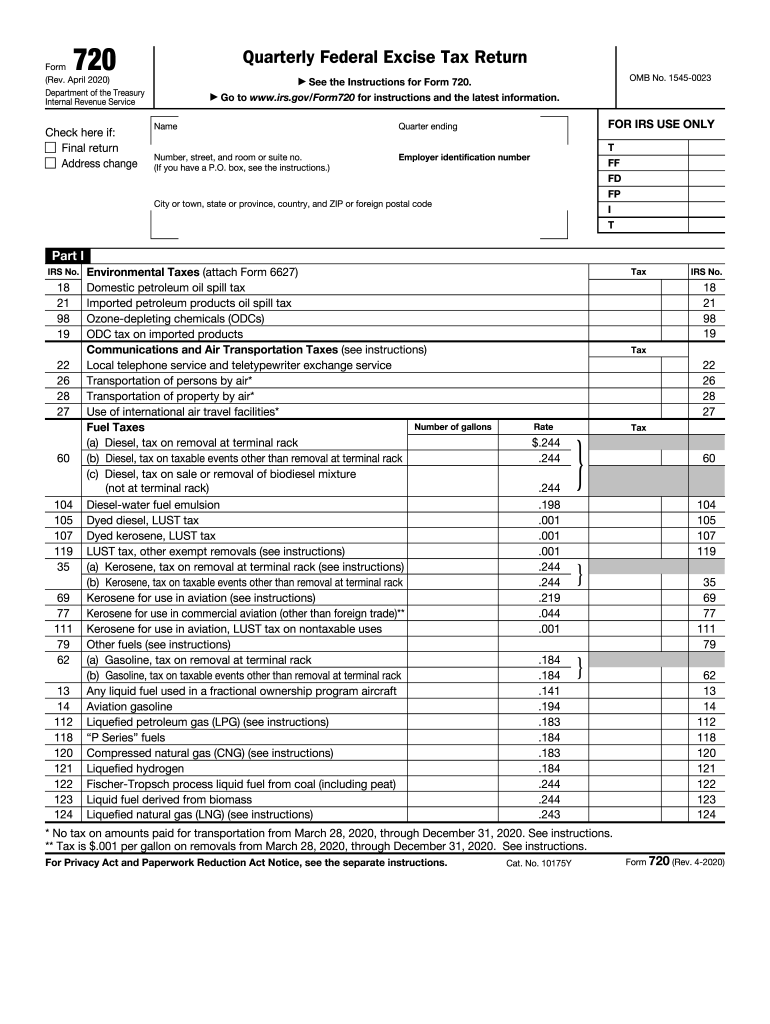

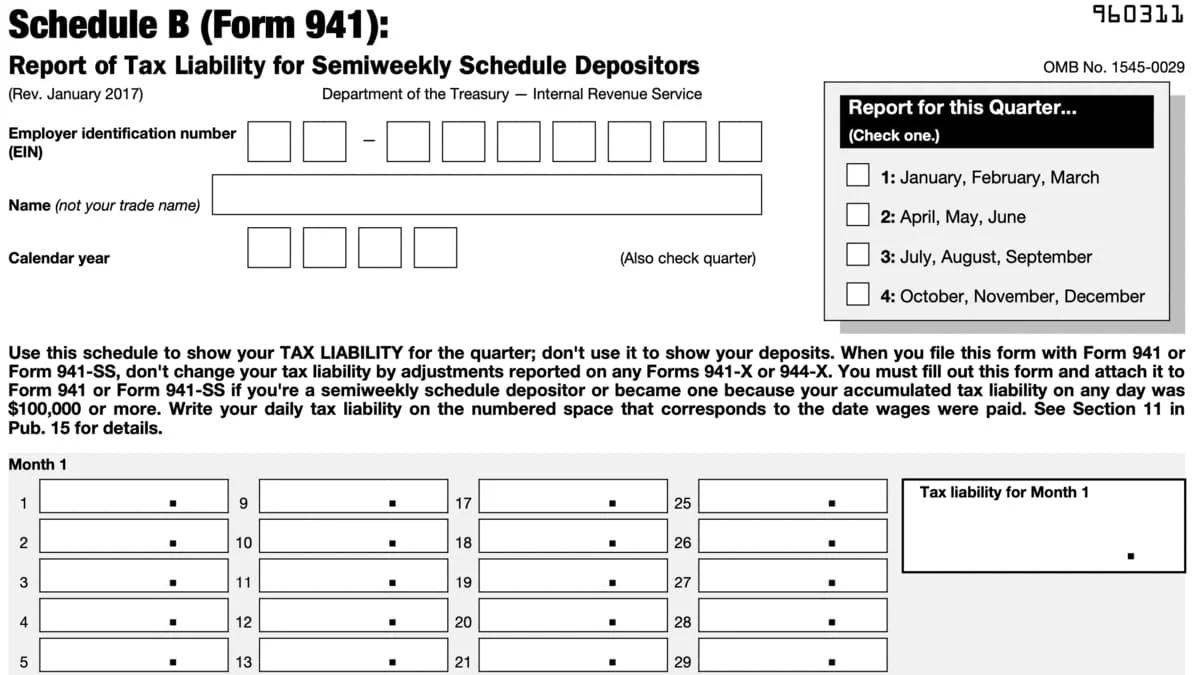

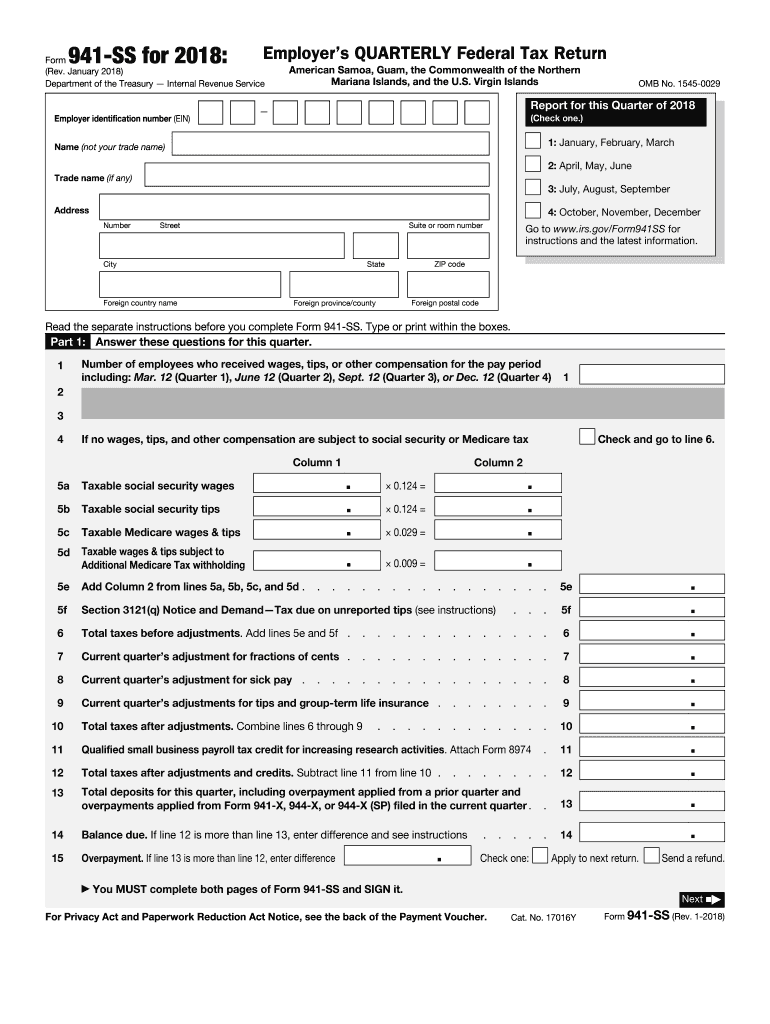

941 Irs Quarterly Report 20182024 Form Fill Out and Sign Printable, / updated january 09, 2025. 16 to avoid a possible penalty or tax bill when filing in 2025.

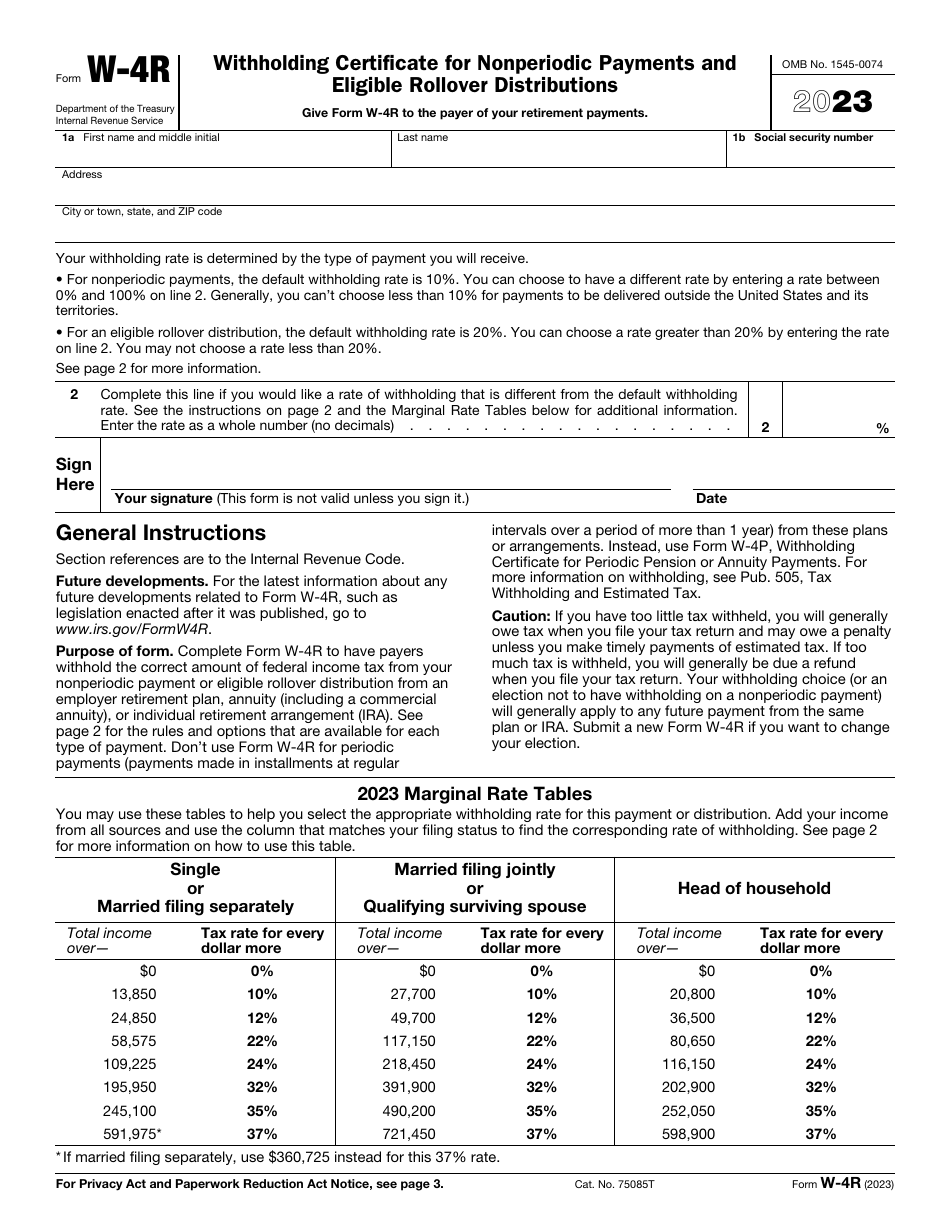

IRS Form W4R Download Fillable PDF or Fill Online Withholding, When are estimated taxes due? When income earned in 2025:

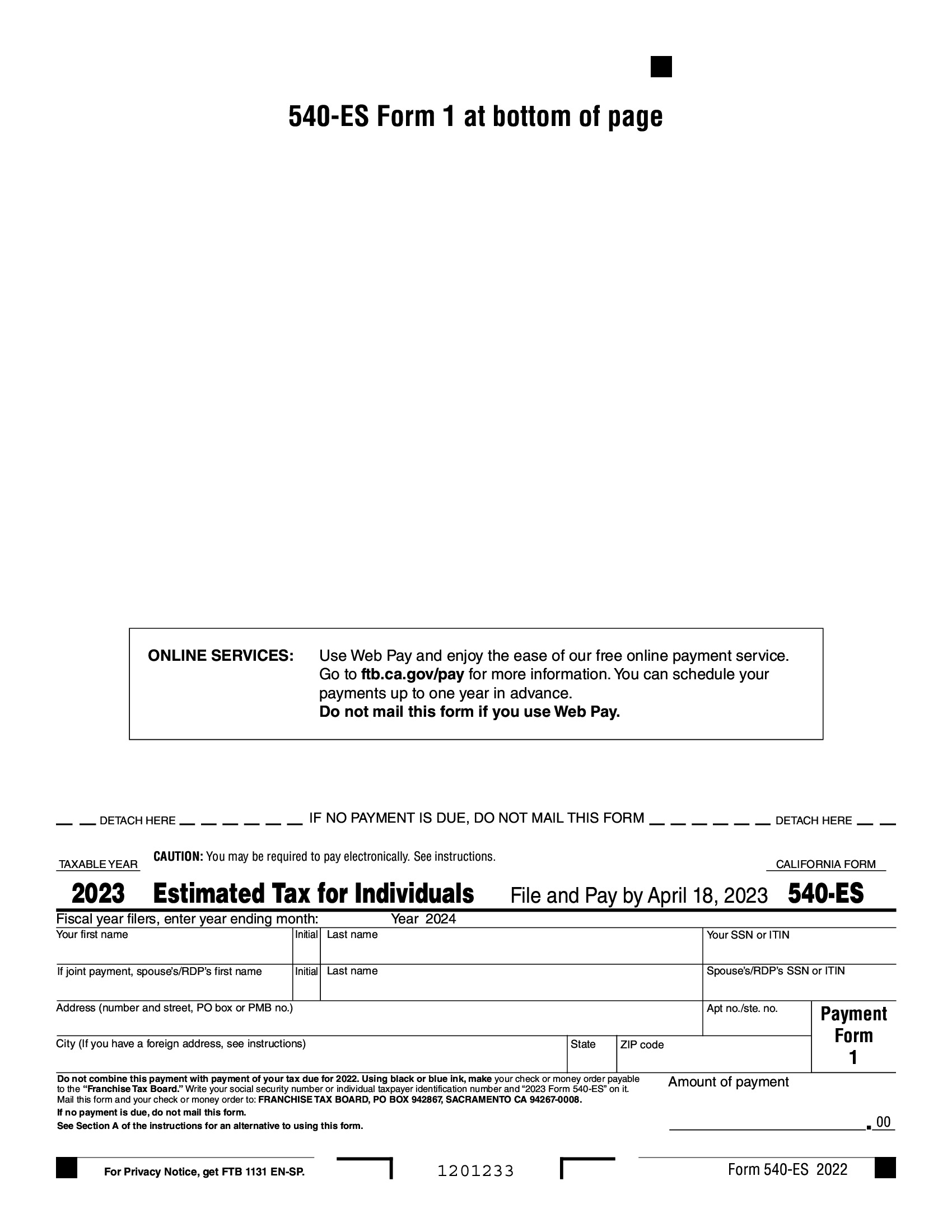

FTB Form 540ES. Estimated Tax for Individuals Forms Docs 2025, 2025 irs tax deadlines you can’t afford to miss. The 8% rate went into effect in late 2025 and is the highest since early 2007.

How to Pay Your IRS 1040ES Estimated Taxes THE Ultimate Bookkeeper, 15, 2025 — the internal revenue service today reminded taxpayers who didn’t pay enough tax in 2025 to make a fourth quarter tax payment on or before jan. The importance of adhering to these dates.

Irs Estimated Tax Payment Due Dates 2025 Tove Oralie, Use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. 4th quarterly estimated tax payment january 16, 2025 (or you can file your tax return by march 1, 2025, with your full remaining payment and not submit this quarterly payment) for tax year 2025, the following payment dates apply for avoiding penalties:

Irs Payment Extension 2025 Henrie Steffane, In a move to facilitate timely tax filing, the cbdt has also. June 17, 2025* payment voucher 3:

It’s important to note that taxpayers anticipating a sizable capital gain on the sale of an investment during the year may also need to make a quarterly estimated tax payment.